Looking at a 100-case sample of herniated disc cases across the State of Florida involving an uninsured or underinsured motorist where the defendant was an insurance company, we can statistically analyze the quantitative data specific to the research question, “How do different defendant insurance companies in herniated disc cases involving an uninsured or underinsured motorist compare to each other?”

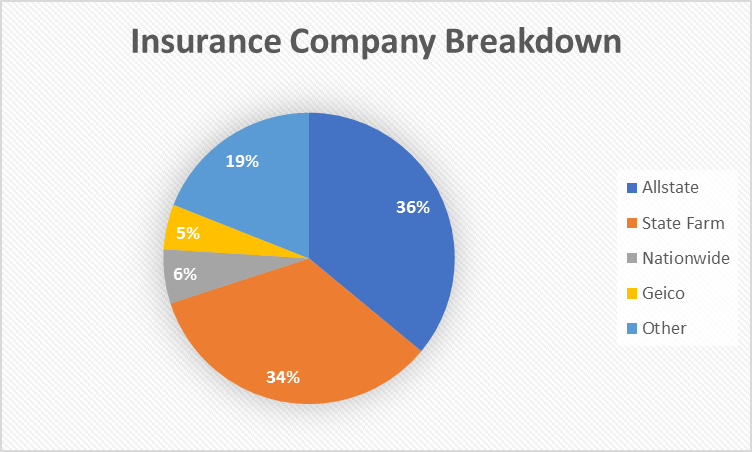

From the 100-case sample, we found that 36% of cases were against Allstate, 34% were against State Farm, 6% were against Nationwide, 5% were against Geico, and 19% were against other, more varied, insurance companies (Fig. 1).

Figure 1. The breakdown of the different insurance companies in the 100-case sample.

With this information, we can now compare the average values of a case in respect to each different insurance company found in the 100-case sample. Cases against Allstate produced the lowest average case value at $58,763.83 including defense verdicts and outliers and $45,159 excluding those measures. When the defendant was State Farm, the average case value of those cases was $104,840.79 inclusive of defense verdicts and outliers and $93,706.78 exclusively. We found cases against Nationwide to be in the middle, with an inclusive average case value of $164,558.33 and an exclusive average case value of $31,087.50. Cases against Geico showed a sample average case value of $202,959.80 inclusively and $90,606 exclusively. Finally, the “Other” category showed the highest sample average case value of $403,033.89 inclusive of defense verdicts and outliers and $97,478.70 exclusive of defense verdicts and outliers.

Moreover, it is important to look at the success rate of the plaintiff against each insurance company in the sample. In 83.33% of cases against Allstate, the plaintiff received a true plaintiff’s verdict and in 2.78% of cases against Allstate, the plaintiff received a settlement; in 13.89% of cases against Allstate, the jury returned a defendant-favored verdict. In the cases where State Farm was the defendant, the jury produced 64.71% true plaintiff’s verdicts, 2.94% settlements, 5.88% comparative negligence verdicts, and 26.47% defense verdicts. Cases against Nationwide showed no defense verdicts, 66.67% true plaintiff’s verdicts, and 16.67% for both comparative negligence verdicts and settlements. In jury trials against Geico, we also saw no defense verdicts, 80% true plaintiff’s verdicts and 20% comparative negligence verdicts. Lastly, the “Other” category of defendant insurance companies produced 73.68% true plaintiff’s verdicts, 5.26% in both comparative negligence verdicts and settlements, and 15.79% defendant-favored verdicts.

Although this information is reliable and accurate, we must note that because the sample was only of 100 cases, and some insurance companies we grouped only made up around 5-6% of that sample, a larger sample size would be necessary to rule out any anomalies and perfect the data to show a more representative average of case outcomes and awards in the trial cases of each insurance company listed in this blog.

To read statistical analysis in other areas of personal injury cases, please visit the homepage of our blog.

If you’re a potential client, or an attorney seeking a second opinion, and would like to discuss the value of your case please feel free to call us anytime at (850)-244-3310.