As a personal injury attorney, the most common thing I hear from my clients when I ask them what kind of automobile insurance they have is that they have “FULL COVERAGE.” Most even tell me that their insurance company told them when they bought the policy that they were buying full coverage. When they heard those words, my clients naturally thought they were covered for every bad event that can happen in a vehicle. I can’t blame them, because that’s what those words seem like they should mean.

However, I am here to tell you that having full coverage does not mean you are fully covered. It is one of the most confusing terms used by the auto insurance industry to get you to buy their policies. They may try to lure you in with a cheap price and say you’re covered, but really it just means you are buying the bare minimum.

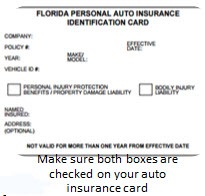

“Full coverage” as insurance companies see it basically means they are complying with the bare minimum state law requirements. In Florida, you are required to purchase auto insurance but that requirement is limited to only two types of coverages:

1) Personal Injury Protection (PIP)/No-Fault Benefits – this states that when you are in injured in a car crash, and you get treatment for those injuries within 14 days, your insurance company will be the first line of defense to pay for your medical bills – even if you are found at-fault for the crash. They will pay 80% of your medical bills; up to $2,500 in a non-emergency medical condition, and up to $10,000 if there is an emergency medical condition. They will also pay for a portion of your mileage and lost wages if a claim is made.

2) Property Damage Coverage – this coverage will pay for damage you cause to another vehicle or to other property. The legal minimum amount of coverage is $10,000.

Many insurance companies will tell you that you are getting full coverage when really they just mean you are only getting the two coverages listed above. What they won’t tell you is that all the important coverages, that aren’t legally required, aren’t included in the definition of full coverage. You need to ask for the following coverages specifically in order for them to be added to your policy.

Having “Full Coverage” doesn’t mean you have purchased Bodily Injury Coverage

A lot of people might be surprised to hear that having full coverage doesn’t mean you have purchased bodily injury coverage. Bodily injury coverage is the type of insurance that protects your assets when you are negligent, and hit a pedestrian or another vehicle, causing them to sustain medical injuries. Without bodily injury coverage the person you hit can sue directly to take your assets in order to satisfy their medical bills and compensate themselves for the injuries they sustained.

Having “Full Coverage” doesn’t mean you have purchased Collision Coverage

With collision coverage your insurance company will repair or pay for the value of your vehicle after it is damaged. If you are found at fault in a collision, often times you may be left without a vehicle because your insurance company won’t pay to fix or replace it. If you are not at fault for the crash, the negligent driver’s insurance should pay to fix/replace your vehicle. But, if that person doesn’t have any insurance, your insurance company will not step in to pay for the repairs without collision coverage.

Having “Full Coverage” doesn’t mean you have purchased Rental Coverage

Your insurance company will pay for a rental vehicle for a limited period of time while your car is being repaired, or while you are looking for a replacement car, if you have rental coverage. However, if you are at fault for the crash your insurance company will not pay for your rental car unless you have collision coverage. If you are not at fault for the crash, the negligent driver’s insurance should pay for a rental vehicle for a limited time, but if that person doesn’t have any insurance your insurance company will not step in to pay for the rental vehicle unless you purchased rental coverage with your policy.

Having “Full Coverage” doesn’t mean you have purchased Uninsured/ Underinsured (UM) Coverage

Uninsured/Underinsured Motorist (UM) coverage is one of the most important coverages you can buy. In fact, insurance companies by law must make you sign a piece of paper called a “UM Rejection Form” stating that you are not buying Uninsured Motorist Coverage.

Basically, Uninsured Motorist Coverage protects you when the driver that hits you either (1) doesn’t have bodily injury coverage (which is common since like we spoke about, bodily injury coverage isn’t required by law) or (2) has bodily injury coverage, but not enough to cover the extent of your injuries. In those instances, you can make a claim on your insurance company for the injuries that you sustained. Without UM coverage, many drivers hit by uninsured drivers don’t have a path to recovery, since the offending drivers often don’t have significant assets.

Despite the UM Rejection Form, I am surprised that many of my clients still either don’t know what UM coverage is or they still think they have UM coverage, because they have full coverage. This tells me that insurance agents might not be impressing on their insureds how important it is to have UM coverage on their policies.

One Last Thing

Bodily Injury Coverage, Collison Coverage, Rental Coverage and Uninsured/Underinsured Motorist (UM) Coverage are all extremely important. DO NOT let an insurance company get away with leading you to believe that you have “Full Coverage” when really you just have the bare minimum. Call your insurance agent today to see what type of coverage you have. If you have any questions please call a Tallahassee personal injury attorney at Fasig and Brooks today at (850) 222-3232 or email me and our attorneys will be happy to help you.