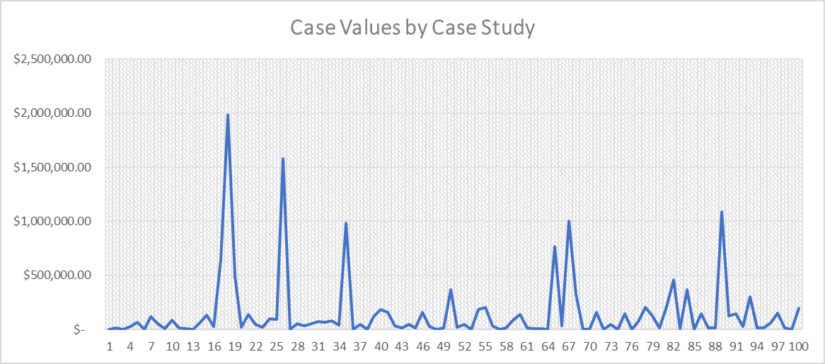

In a sample of 100 uninsured/underinsured (UM) cases involving herniated discs taken from jury verdict research across the State of Florida, we saw twelve high-value outliers in the data set. For this sample, the outlier threshold was set at any case value over $299,500 due to this sample’s data distribution. The twelve case values in this data set that were high-value outliers were $299,501, $320,220, $370,000, $461,227, $493,000, $652,375, $765,000, $985,345, $1,000,313, $1,089,111, $1.578 million, and $1,984,199. These outliers significantly deviate from the normal trend of case values; this deviation from the sample norm can be seen in Figure 1.

Figure 1. In this line graph, you can see the outliers of the sample data indicated by the high peaks of each high-value case.

Statistically speaking, outliers are suggestive of values that go far above (and sometimes below in certain data analyses) the normal trend seen in a specific data set; outliers call statisticians and researchers to give attention to a data value to find out the cause of why that data value outlies the normal trend. In terms of legal statistics, outliers call anyone analyzing jury verdict research to look at the specific case and its case information to try and understand why some cases receive higher awards than a different but comparable case. High-value outliers should also be analyzed in terms of their ability to skew the average of a data set from their extraordinarily high value, so it’s important to always calculate averages with and without the outliers for the most representative average of a data set.

While analyzing the UM herniated disc cases, we saw twelve high-value cases, which normally have extenuating circumstances warranting their high values. To symbolize this, let’s look at some examples.

In Case Study 95, we saw a total verdict of $299,501 and a plaintiff suing Allstate Insurance Company for uninsured motorist benefits following a chain reaction vehicular accident. The plaintiff claimed he had uninsured/underinsured motorist benefits with Allstate and that he was entitled to compensation for his herniated disc injury at L4-5. Allstate denied that the person who the plaintiff claimed caused the accident was negligent and that the plaintiff himself was negligent; the defendant also claimed a separate, non-party motorist was contributorily negligent.

Another case, Case Study 37, involved a plaintiff suing Traveler’s Indemnity Company for uninsured motorist benefits following a collision at a controlled intersection which resulted in a herniated disc requiring discectomy and triple fusion surgeries. The female plaintiff claimed she was struck by a stolen vehicle when the driver failed to stop for a red light at the intersection. Obviously, a discectomy and triple fusion surgeries are both expensive and painful and the jury recognized this, awarding the plaintiff with $985,345.

Case Study 91 involved a plaintiff suing State Farm Automobile Insurance Company for uninsured/underinsured motorist benefits following an unspecified collision which resulted in disc herniations at C5-6, C6-7, a bulge at C4-5 and disc protrusion annular tear at L5-S1 requiring surgery. The plaintiff claimed the defendant, his insurer, denied his claim for uninsured motorist benefits. He further claimed that he was issued a policy of insurance under which he was entitled to uninsured motorist benefits and that the defendant failed to honor the provisions of the policy. The defendant admitted the plaintiff had uninsured insurance with them, but disputed the extent and permanency of his claimed injuries. In this case, the jury awarded the plaintiff $1,089,111 which included $205,000 for pain and suffering.

Finally, Case Study 20 involves our highest outlier of $1,984,199. In this case, a plaintiff sued Ace American Insurance Company for uninsured motorist benefits following a car accident where an underinsured motorist failed to yield to a vehicle in which the plaintiff was a passenger resulting in a herniated disc at C5-6 with surgical fusion and adhesive capsulitis of the left shoulder which also required surgery. The plaintiff claimed she was in a vehicle operated by her husband when an underinsured motorist turned left in from of the vehicle in violation of the right-of-way. The judgment was ultimately reduced to $500,000 pursuant to Florida law to conform to the plaintiff’s uninsured motorist policy. The plaintiff filed a first party bad faith claim against the defendant to cover the full amount of the verdict.

If you’re a potential client, or an attorney seeking a second opinion, and would like to discuss the value of your case please feel free to call us anytime at (850)-244-3310.